A common question we hear from clients is, “I need to withdraw cash from my portfolio. When should we sell investments to raise that cash?”

As we’ve discussed in other posts, timing the market is very difficult. You might get it right a time or two, but outside of that, it’s almost impossible since the market is so dynamic and complex.

You may have also heard sayings such as “sell in May and go away,” which says to sell your stocks in May as market returns are usually weaker in the summer months.

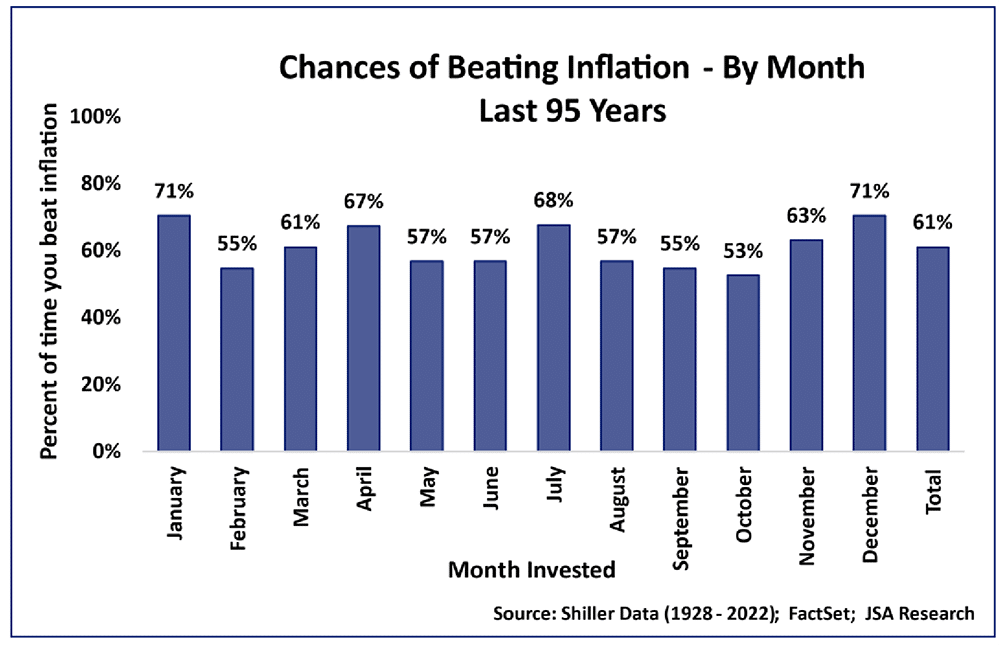

What to do? The best way to start this discussion is to see what’s happened in the past. The chart below shows real (after inflation) stock market returns in the United States by month for the last 95 years.

If you’re investing for one day, it’s a coin flip whether the market will be up or down. However, if you invest for a month, chances are that about 61% of the time, you’ll earn a return that beats inflation (the right-most column in the graph).

You can see there is some difference by month. For example, there’s a higher chance of better returns in November and December than in September and October. The big question is why?

Just because it’s a particular month, does that drive stock returns? Probably not.

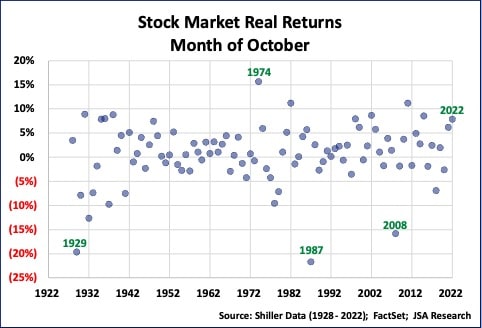

Let’s look at the worst month, October. We’ll pretend you did this work back in September and sold your stocks (because October has the worst historical investment returns). Guess what. You would have missed out because this October produced almost an 8% return.

If we had used a shorter period, October would have looked much better (once we get rid of the months during the 1930s Great Depression).

This is all to say that timing the market is really hard. You can improve your odds, however, by being a long-term investor. In fact, investing for five years or more (rather than a month that we’ve talked about here) really improves your chances of getting a good investment result. That’s why creating a plan and sticking to it is so important!

So, back to our original question.

If you need money from your portfolio, when should you take it out?

- If it’s a small amount of your portfolio, wait until closer to when you need the money. After all, the odds are in your favor to stay invested.

- If it’s a large amount of your portfolio, it’s better to have the money ready for when you need it well beforehand. For example, you wouldn’t want your home down payment invested in stocks until the closing day. Instead, that money should be in short-term bonds, cash, or sitting in your bank account well before it’s needed.

We hope this helps the next time you need cash from your portfolio.