In this follow-up piece, we’re reviewing a real-life example of an “income” or “dividend” portfolio and its results, as compared to a portfolio built for total-return. If you missed that piece, it’s here.

Recall that, while one could say the income portfolio provided the necessary income in retirement, the total-return portfolio did that AND ended with more money. In this note, we’ll answer three key questions:

- What really happened?

- Why?

- What are some common flaws of portfolios built with too heavy of an “income” focus?

What Really Happened?

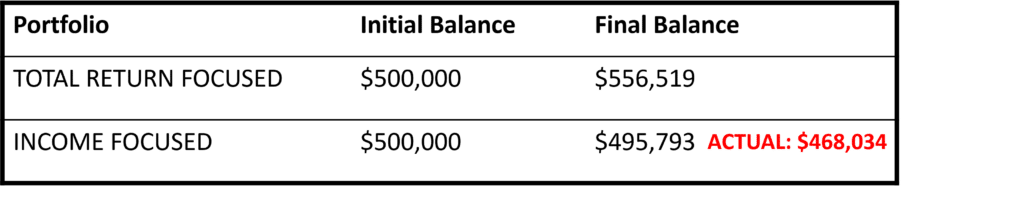

The table from the prior piece showed that the Income-Focused portfolio had around $496k after four years, before fees. In reality, our investor ended up with just $468k. Knowing that the real balance was LOWER than the original principal, we may no longer call the portfolio a success.

Where’d the extra $28k go???

In fact, if we compare it to the total-return portfolio, we’d ask, where’d the extra $88k go???

Here’s a breakdown of the big issues:

1) Poor Stock Investments – Middling Companies in Middling to Unfavorable Industries

Our preference is to focus on cash flows (an even better word for us: “returns”), and not dividends as a key decision point. In this case, several stocks were chosen simply because they paid a large dividend. Several of these stock investments paid their dividends, but ultimately our investor didn’t really make money in them. One company even lost money for the investor in a four-year period, even counting the dividend.

In our opinion, these companies were in mediocre (pharma, foreign industrials) to uninvestable (auto) industries. What’s worse, is the companies chosen have a history of not being shareholder-friendly in our view – I.E. they do “silly” things with company money. We just don’t prefer this.

2) Over-Reliance on Expensive, Under-performing “Active” Mutual Funds

All but one of the mutual funds didn’t do very well. Eventually, some were swapped out with other funds, also with mediocre success. Keep in mind, high-expense “active” mutual funds need to outperform their fees to add value in a portfolio. In this case, the funds didn’t do that. We have a term for a portfolio with too many funds: “a Mutual Fund Junk-Drawer”. This looked like that, and after four years, it earned the “junk drawer” results.

There’s much we could write about this topic because two of the partners at JSA come from the mutual-fund industry. Adam was responsible for running a fund, and Rich spent years as a research analyst supporting five different mutual funds. They’ve both “seen the sausage made inside the factory.” Because of that, JSA has a unique perspective on what can go wrong at mutual funds.

While not all mutual funds are mediocre or worse, we find that most of them are. Yet, what often happens is a portfolio gets loaded with way too many of these types of funds, built by “advisors” across America (the reason for quotes is beyond our scope here). A “junk drawer” like this rarely works out well.

3) Fees, Fees, Fees

Related to the prior point (having too many active funds with high fees), the portfolio itself ALSO charged a fee. Now again, fees aren’t all bad if the investor is getting more value than what they are paying. The total expense for this portfolio, with funds and fees, was around 1.5% per year. In this case, fees were a part of the reason the investor wound up with less money.

4) Under-Diversification

A common problem with “Income-Focused” portfolios is a lack of diversification. In our case here, all stocks were high-dividend-payers, and many of the bonds were “high-yield” (also called “junk bonds”).

What that means is the portfolio itself is heavily skewed to betting on one particular style of investments, and that’s it. It’s important to understand this common under-diversification problem with these style of portfolios.

Putting it all together:

Often investments that appear attractive because of their “high yield”, “high dividend”, or “high income” look that way because something else might be going on. There’s a term in investing: “the chase for yield,” which refers to the idea that, in the interest of going after a high dividend (or rent if we talk about real-estate), an investor takes on a risk that he/she does not understand, which can ultimately backfire. Skepticism is healthy in these cases. For example, see this infamous Reddit thread about someone holding the stock of one of my former employers!

All the traits we’ve noted about this case study are quite common with portfolio construction when “income generation” becomes the sole focus. At JSA, we prefer to focus on generating “cash flow” and not “income.” The result is a more “total-return” investment approach.

Our view on the stocks is – if you’re going to take the RISK of owning stocks, then try to invest in the best companies you can to make money, because ALL STOCKS ARE RISKY. Focusing on just a dividend, in our view, misses the bigger picture of looking at all of a company’s financials (and its competitive situation).

On the bond side, we often see portfolios with an over-reliance on “high-yield” (aka “junk”) bonds. Like stocks, junk bonds also do quite poorly when big stock market drops come. However, unlike stocks, junk bonds have a limited upside. It’s not that they don’t have a place in portfolios – we think they do – but we don’t like to overdo it. We think taking on some of that volatility might be better suited to stocks, where upside can be much greater.

At JSA, we are researchers, problem-solvers, and investors, with some unique skills to help guide our clients along the way. We want all of our clients to be better off with us in their lives, and we’ll use what we think are sound investment and planning practices to do that. That’s why our investment philosophy focuses instead on Cash Flow and Total Return.